Overall, 2023 was a slower year in the Whistler and Pemberton real estate markets, allowing inventory to tick up while prices held. The main drivers of the lower sales volume were the impacts of inflation on households and the overall borrowing power of buyers as a result of the sustained high-interest rates throughout the year.

WHISTLER

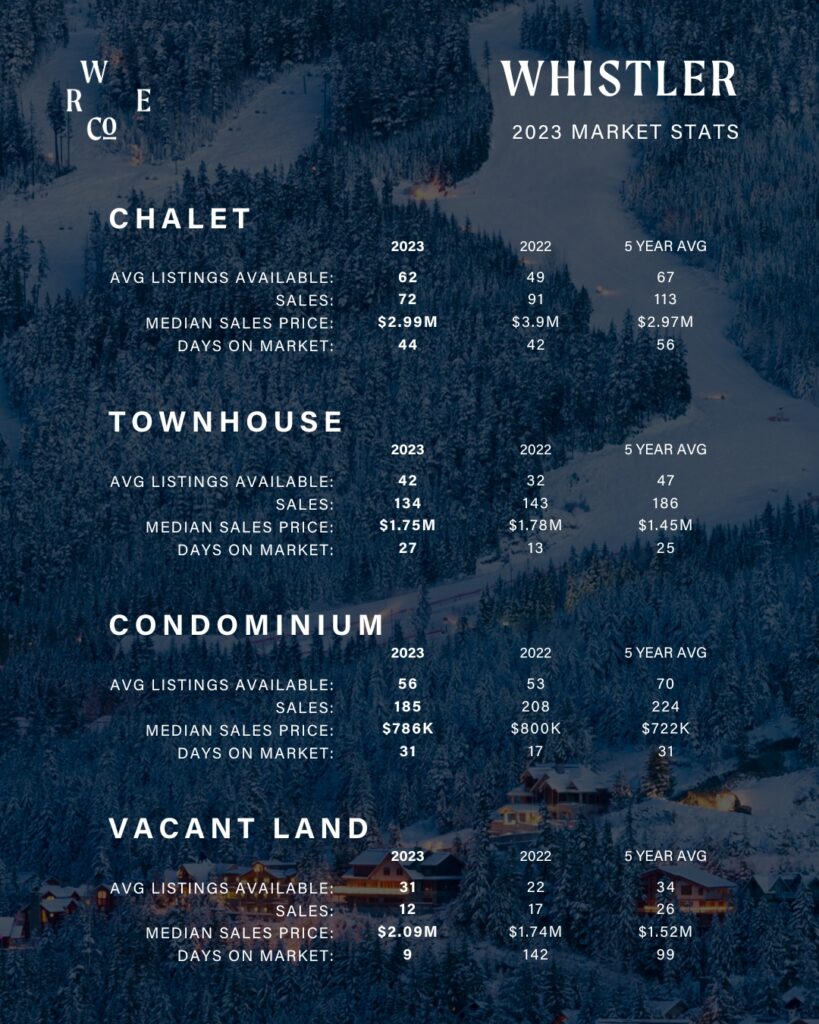

In Whistler, there were a total of 490* sales in 2023, which is a 13% drop from 2022 and the lowest annual sales volume our market has seen in the last 10 years. Total sales dollar volume in the Whistler market was $867M, about $60 million shy of the 10-year average. Prices, however, remained strong, with the median sale price of a Whistler property surpassing both the 2020 and 2021 medians from the heat of the pandemic market. The median number of days for a property to sell in 2023 was 32, up from 21 in 2022, but remains below the 10-year average of 39 days. Despite a slower overall year for the market in 2023, the luxury segment remained strong with 39 sales of over $4M in 2023, including a record-breaking $32 million sale. With Whistler’s exclusion from Canada’s foreign buyer ban, international buyers continued to purchase properties in 2023, accounting for approximately 13% of property purchases and 20% of dollar volume. The largest contingent of international buyers came from the United States, with US buyers representing 8% of all property purchases in the Whistler market last year.

Regarding inventory, there were 838* units brought to market this year, which is 50 fewer than last year, and the lowest number of units to hit the market in the last decade. Despite this, inventory levels were higher month-to-month versus last year (which witnessed a slow climb up from record-low inventory levels in December 2021) due to the slower sales volume, offering potential buyers more choices than they had throughout the last couple of years.

PEMBERTON

In Pemberton, there were 98* sales in 2023, up slightly from 93* in 2022, but 32% below the 5-year average. Continued high borrowing costs are responsible for the sustained below-average sales numbers. Prices remained strong with a median transaction price of $852,000, the highest Pemberton has seen. This stemmed from a notable increase in luxury sales in Pemberton in 2023 with 7 sales over $2M versus only 3 in 2022. The median days to sell for a property in Pemberton was 33, up from 23 in 2022 but still well below the 5-year average of 37 days.

Regarding inventory, there were 199* new listings brought to market, 34 of which were parcels of vacant land. The average number of units available this year was 66*, up 14% from the 5-year inventory average.

LOOKING AHEAD TO 2024

Looking to 2024, we expect to see increased sales volumes in both the Whistler and Pemberton markets. As inflation approaches the target range and the past two years of quantitative tightening measures work their way through the Canadian economy in the form of mortgage renewals, it has been predicted that the Bank of Canada will begin dropping interest rates in 2024. There has already been some downward trend in longer-term mortgage rates. This would increase the buying power of consumers and fuel the housing market, with the Canadian Real Estate Association Predicting a 9% increase in home sales and a 1.5% increase in home prices this year. We expect increased competition in the Whistler and Pemberton markets, which both have limited supply and strong demand.

*excluding parking stalls

The information provided is based on data collected from the Whistler Listing System.

This information is general in nature and is provided for information purposes only.