January 2023 was a very slow month in terms of sales, but the markets rebounded in February and March. This came as a function of increased economic certainty, as the Bank of Canada has signalled that interest rate increases have likely come to an end. The return of some certainty in terms of rates has led to an increase in market activity, with our inventory still being low this has even resulted in us seeing the return of multiple offers.

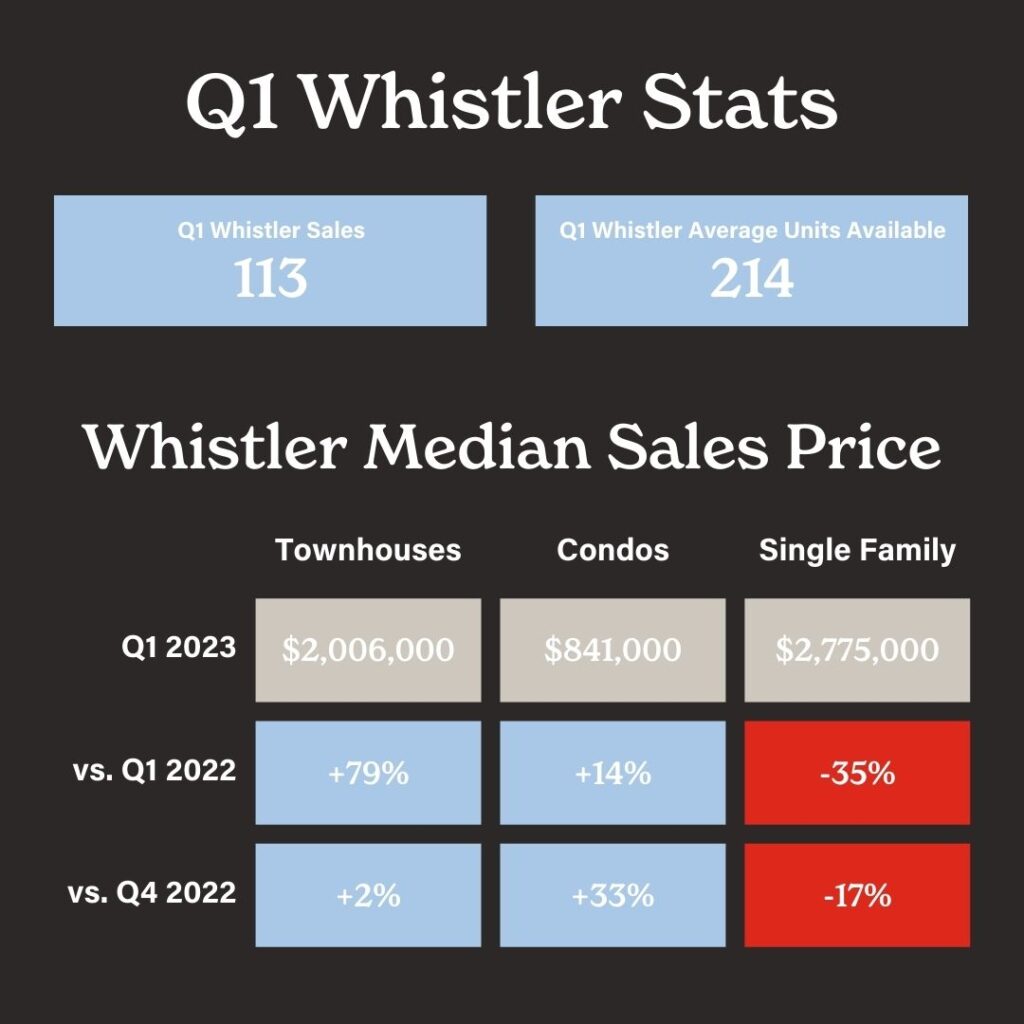

In Whistler, there were a total of 113* sales in Q1, with 93* of those sales, accounting for 82% of all Q1 sales, coming in February and March. Inventory improved slightly throughout the quarter, rising from 200* units in January to 229* In March, but inventory remains a major market constraint. The median sales price of properties increased both year-over-year and quarter-over-quarter for townhouses and condos, while the market saw a slight decrease in the median price of single-family homes.

Looking Forward

Looking to Q2, we anticipate an increase in inventory as ski season and rentals wrap up and sellers may be more interested in putting their properties up for sale, ultimately fueling the spring market. From an economic standpoint, some uncertainty remains as a result of the recent Silicon Valley Bank failure, which may make this a good time to invest in less volatile assets such as real estate.

Real Estate News You Should Know

Before we wrap up, and as the tax deadline approaches, we wanted to mention Canada’s Underused Housing Tax, new for the 2022 tax year. Generally speaking, the UHT is an annual 1% tax on residential property owned by a non-resident, non-Canadian that is deemed to be vacant or underused by the Canadian Revenue Agency (CRA). There are situations, however, where the tax or reporting obligations could apply to Canadian citizens or residents, so it is important to understand whether you are an excluded or affected owner based on your specific situation. The application of the Underused Housing Tax is quite complicated, and we recommend that you talk to your accountant about how it may impact you and your Whistler or Pemberton property. Filings are due April 30, 2023, but due to the confusion surrounding the UHT, the Federal government will waive penalties and interest for any late-paid UHT as long as the return is filed or UHT is paid by October 31st, 2023.

*Excludes parking stalls