Over the first quarter of 2024, inventory levels ticked up, as did consumer confidence as a result of the Bank of Canada holding interest rates steady and suggesting that the first interest rate decrease will take place later this year. This has set the table for what we anticipate to be an active spring market.

Whistler

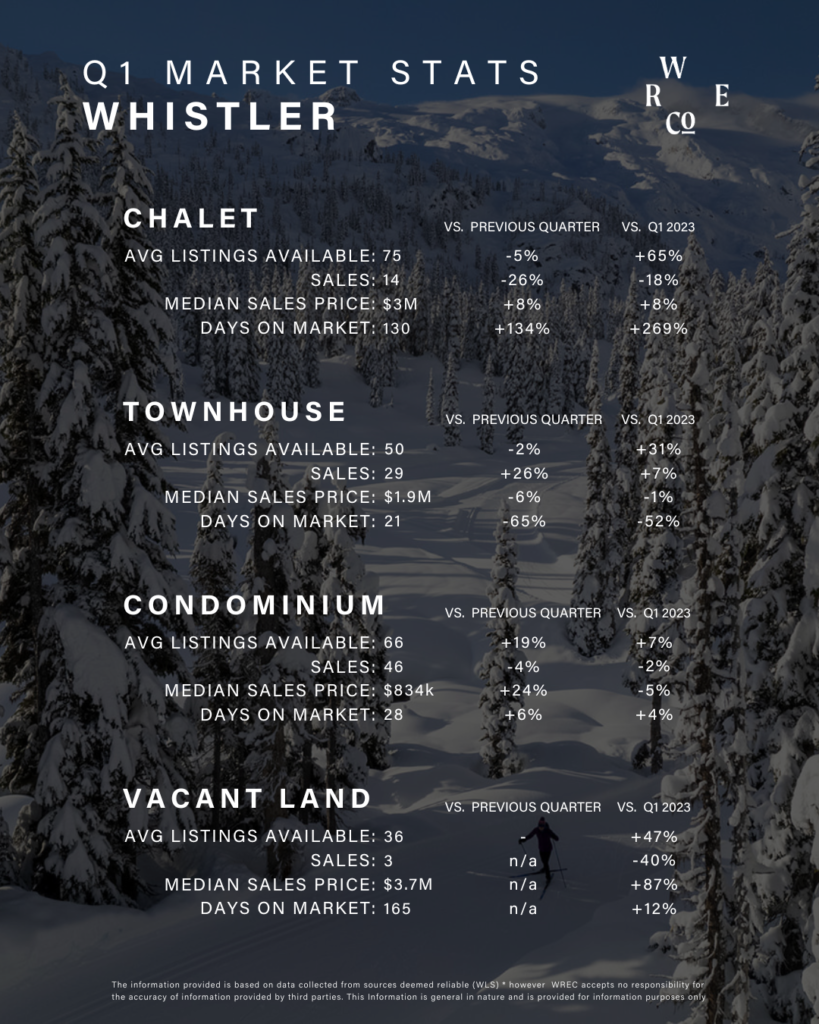

In Whistler, there were a total of 117* sales in Q1, with sales increasing for two consecutive months in January and February and a slight slow-down in March. Overall sales volumes were in line with the same period last year, however, the year-to-date dollar volume is up 9% vs Q1 2023. This is reflective of notable activity in the luxury market, with 12 sales over $4M in the quarter. We are proud to share that Whistler Real Estate Company agents represented either the buyer, seller or both in 11 of those 12 transactions. There were also record-setting deals in the condo and land categories that closed in Q1, further reinforcing the continued strength in the luxury market in Whistler. Buyer’s origin for Whistler was fairly typical, with 81% of purchasers and 82% of dollar volume coming from Canada. There was a slight increase in dollar volume from US buyers, who represented 13% in Q1 vs 10% in 2023. Listings increased across all categories vs Q1 2023, with single-family and townhome inventory rising 65% and 31%, respectively. Overall, the Q1 market conditions in Whistler were balanced.

Pemberton

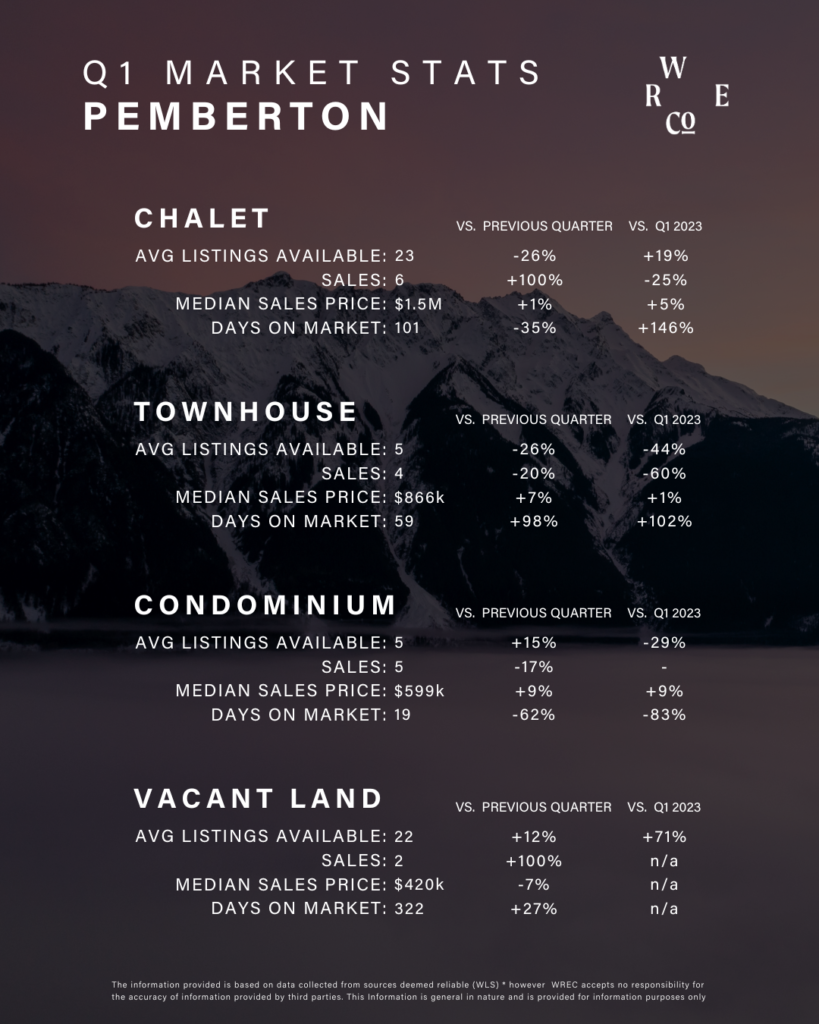

The Pemberton market saw 17 sales in Q1 – 4 chalets with acreage, 2 chalets, 4 townhouses, 5 condos and 2 parcels of vacant land. This is 13% increase in sales from Q4 of last year, but a 26% decrease year-over-year.

Median sales prices for single-family homes, condos and townhouses were up slightly when compared to both the previous quarter and the same period last year, likely as a result of mortgage rates starting to come down. In regards to luxury sales in Pemberton, there were 2 sales over the $2M in Q1. In terms of buyer origin, 82% of Pemberton buyers in Q1 were from Pemberton or Whistler, with the additional 18% coming from Vancouver and West Vancouver. Inventory increased from 61 to 73 units over the course of the quarter, including 24 vacant lots presenting the opportunity to build. Overall, the Pemberton market leaned in favour of buyers in Q1.

Looking Forward

We expect momentum to build in both the Whistler and Pemberton markets. From an economic standpoint, it is expected that Canada will avoid a recession and achieve the desired “soft landing” as we approach the 2% inflation target. The next interest rate announcement is April 10, when economists anticipate a rate hold, but may be influenced by the intentions of the US Federal Reserve. Overall, the second half of 2024 is expected to be stronger than the first half and will drive the real estate markets in both Whistler and Pemberton.

As inventory levels have improved, it may be prudent for interested buyers to act now to have more choices and avoid peak competition. Active or prospective sellers may also want to consider the new capital gains tax increase that will apply to the sale of properties other than primary residences as of June 25, 2024.

*excluding parking spots