Over the quarter, inventory levels continued to rise in both Whistler and Pemberton, which came as a function of both typical spring market activity and the capital gains changes that went into effect towards the end of the quarter. April was a busy month for sales in both the Whistler and Pemberton markets, which was followed by a slower May and June as the much-anticipated interest rate decrease at the beginning of June didn’t move the needle in terms of generating market activity.

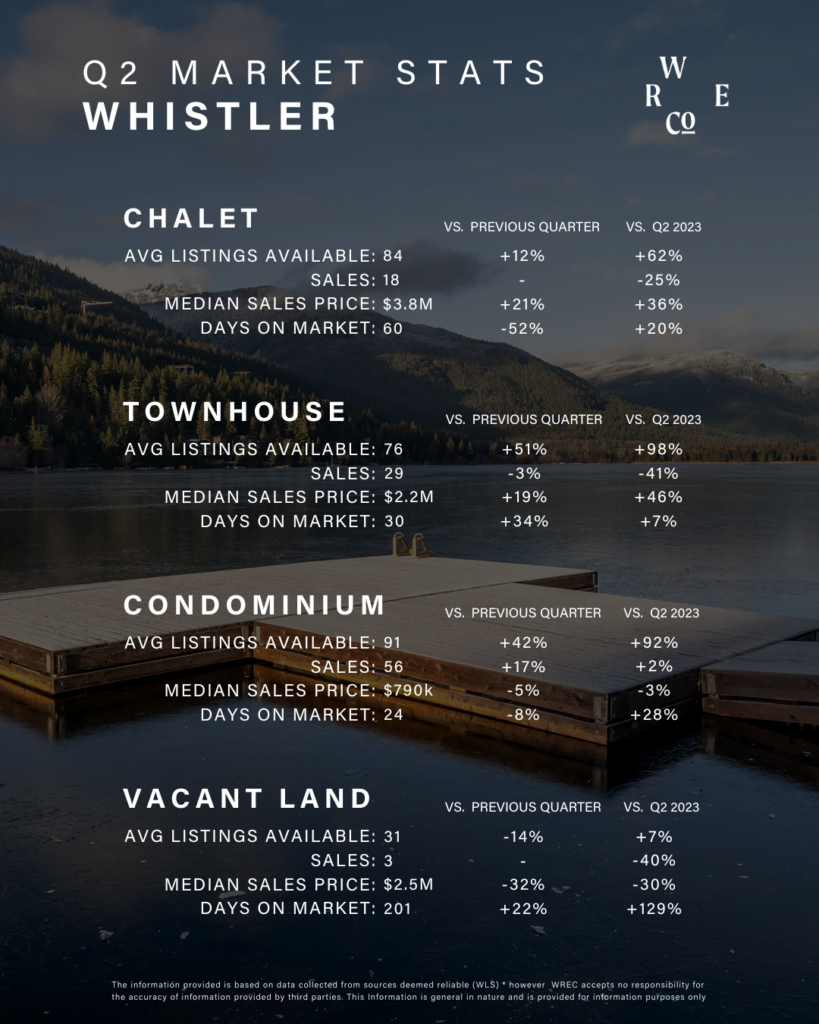

Whistler

In Whistler, there were a total of 136* sales in Q2, with approximately half of these sales coming in April. Overall, this is a 16% increase vs Q1, but down 18% from the same period last year. Despite sales volume declining over the quarter, the median sale price increased each month as a result of the product mix sold. The luxury segment, although slower than Q1, remained active with 10 sales over $4M in Q2. Buyer’s origin for the first half of the year in Whistler was typical, with 83% of buyers coming from British Columbia, 2% from the rest of Canada, 8% from the US and 5% from other international locations. There was a listing boom likely due to the capital gains change, with 315 new units coming to market throughout the quarter. Total market inventory currently sits at 346 units, 50% above inventory at this time last year and 23% above the 5-year average. Overall, Q2 market conditions in Whistler were balanced, with a slight lean in favour of buyers.

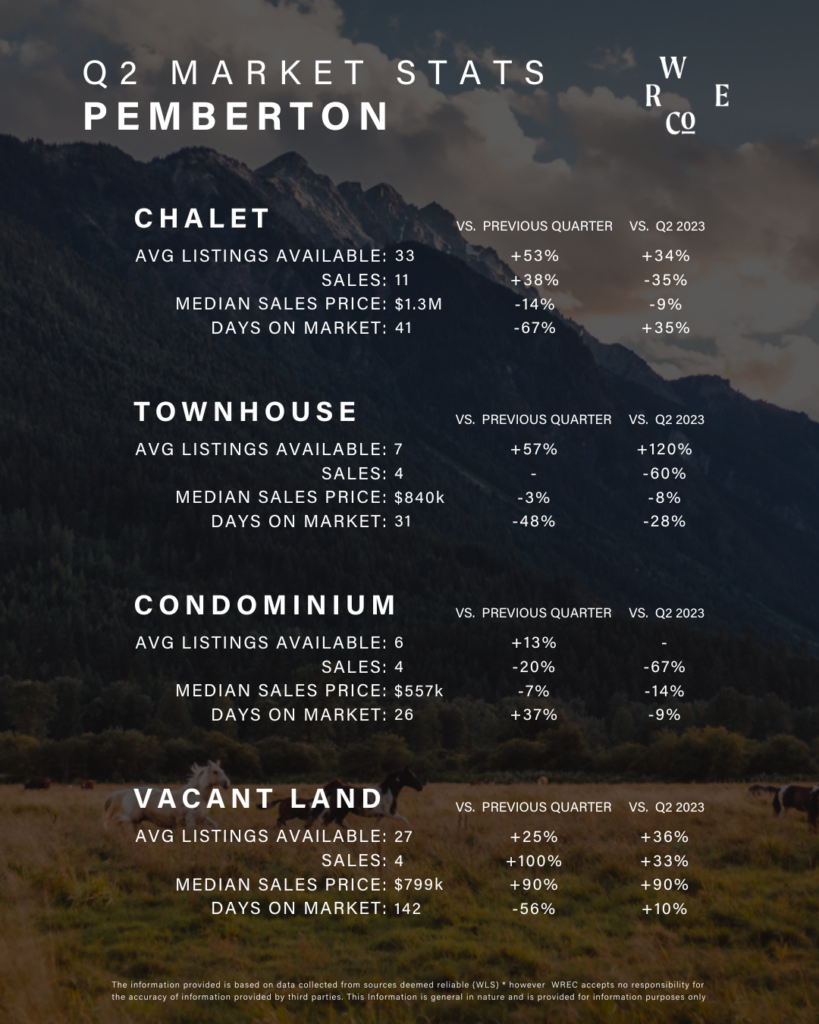

Pemberton

There were 31* sales in Pemberton in Q2, almost doubling the sales volume from the typically slower first quarter of the year. Year-to-date, there have been 17 fewer sales than there were at the end of Q2 2023. Median sales prices are down across all categories, likely because of the continued sensitivity of the market to mortgage rates. Inventory increased by almost 40% from April to June and currently sits at 94 units, which is the highest level Pemberton has seen since August 2020. There was one luxury sale in Pemberton over the $2M price point in Q2 vs two in Q1. 37% of Pemberton buyers originated from Whistler, 33% from Pemberton, 16% from the Lower Mainland and 8% from other areas of BC. Overall, the Pemberton market tilted in favour of buyers throughout Q2.

Looking forward

Summertime in the Whistler and Pemberton markets is traditionally slower, with a pickup in the late summer to early fall as buyers look for places for the upcoming snow season. We may also see an inventory correction with the deadline to sell to avoid the new capital gain increase now passed and some unsuccessful sellers possibly taking their properties off the market.

Economists expect the Bank of Canada to hold rates at the end of July announcement, and introduce further reductions this fall, which we hope will entrench the historical summer and fall market patterns. We haven’t yet seen any momentum from the initial 0.25% interest rate decrease announced at the beginning of June. Although in line with past rates, they are still notably higher than what borrowers have become accustomed to and overall, there is still a lot of economic uncertainty, some of which is being fueled by the volatility in the US market due to the upcoming November election. As a result, a lot of buyers and sellers are in “wait-and-see mode”, but for those who are motivated, there is an opportunity to be had from both perspectives.

*excluding parking stalls